In a year where ex-farm wheat prices have been in a range of over £70/t from top to bottom, Frontier has reported an October-December UK, base feed wheat pool price of £180.12 (net).

Location premiums (where applicable) and quality premiums are paid on a load by load basis. This often takes the base price significantly higher.

Andrew Flux, grain procurement manager for Frontier, says: "As a truly national pool with members from Dorset to Aberdeenshire, farmer grain which is marketed through our pool is always valued on an individual basis.

"Our trading team works very hard day by day, monitoring global markets on behalf of farmer members and acting to secure the results we see today."

In addition to expert market analysis, Frontier has strong relationships with a wide range of end grain consumers. Through these links Frontier is also able to secure impressive premiums for pools members for everything from top specification milling wheat to hard and soft feed wheat. (Top specification milling wheat gave up to an additional £30/t while soft and hard non-bread wheats up to £20/t more.)

These results follow Frontier's top quartile harvest pool result of £174.09/t and further demonstrates Frontier's ability to consistently deliver excellent pool performance.

Rob Hayward of Cousins Farm Ltd at Little Bardfield near Braintree has been marketing grain with the Frontier pools for a number of years:

"The performance is consistently good and last year was excellent. For example, I'd budgeted £185 for my Battalion milling wheat (11.3% protein) and the Frontier pool actually paid £200.12 - beating our budget by £15!"

"As far as I am concerned, the guys at Frontier who market grain for me are a lot closer to the marketplace than most farmers. That gives me reassurance because I know I am more likely to get a good overall price - no matter what the year ahead brings. The pools take some of the risk out of selling that exists if you trade everything on an open market. I've always used the pool but this last year more than ever and that's because the market is so volatile - I think that will continue."

Frontier 2012 Oct - Dec results speak for themselves:

Wheat £180.16/t

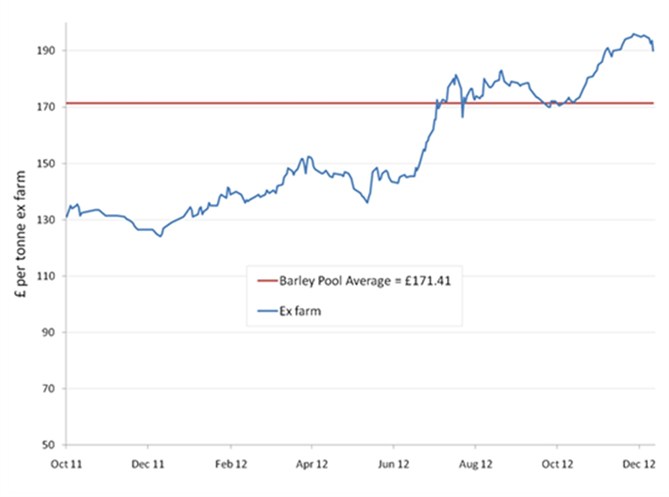

Feed barley £171.41/t

For an informal discussion about grain marketing and risk strategy contact your local Frontier farm trader or call the Frontier customer communications team on 01522 860025 to arrange for someone to call you.